TAL Insurance

Claim Lodgement Portal

An insurance claim lodgement portal designed for third parties representing claimants, aiming to simplify and expedite the claims lodgement process.

DURATION

32 weeks

TOOLS

Figma, Miro

TEAM

1.5 x Product Designer | 1 x Tanzu Labs, 0.5 x TAL

2 x PM | 1 x Tanzu Labs; 1 x TAL

4 x Engineers | 2 x Tanzu Labs; 2 x TAL

CONTRIBUTIONS

Led all product design related activities

Workshop facilitation

Stakeholder management

-

Third-party users - Act as representatives for claimants during the claims process. Typically, these are solicitors engaged by claimants to navigate the claim proceedings on their behalf. They can also be an admin staff in a company that helps provide necessary details for the claim.

Group insurance policies - Group Insurance is typically a pooled insurance product offered via a super fund or employer to a group of people. In this arrangement, the super funds own the policies, with TAL serving as the underwriter.

Super fund - Superannuation, or 'super', is money put aside by the employer over one's working life to prepare for life after retirement.

Notification - Claims notification is the process of informing an insurance company that a loss has occurred and that the policyholder intends to ask for money as a result.

Lodgement - Lodgement is the step where the claim is being made official, typically when required documents such as claim forms have been submitted to the insurance company.

Project overview

TAL is a leading life insurance provider in Australia. In FY2022, the company paid $3.5 billion in claims to 45,301 customers. Besides the challenge of assessing a high volume of potentially complex claims, the current claim lodgement process introduces friction for TAL to get the claims into the assessment queue.

Goals

Aligning on what we want to achieve as a team.

The project team collaboratively set clear goals with stakeholders to help us navigate the project and also to act as a benchmark for assessing the success of the product.

Business goals

Enable digital lodgement for third parties (i.e. solicitors, company admins)

Reduce time from claim notification to lodgement

Product goals

Reducing the steps / interactions for users to start providing information for a claim

Provide a simple and intuitive user experience for claim lodgement

Problem

Manual claims lodgement process causes delays in processing claims.

The current manual claims lodgement process that relies on paper forms and emails is cumbersome, time-consuming and error-prone. This inefficient process led to delays in claims processing and payouts which resulted in problems for the customers (claimants) and the business.

Claimants

Claimants facing financial urgency encountered significant delays in receiving timely payments.

Business

Missing and incorrect documentation delays the claim assessment process, requiring multiple back and forth before assessment can begin.

The business has to ensure that all claims are processed timely in accordance to the Life Insurance Code of Practice in Australia.

Solution

A lodgement portal for third party users to lodge and track claims.

My team and I built a lodgement portal that enables third party users to easily lodge claims on behalf of claimants and keep track of all claim statuses. We initiated a pilot with one partner super fund, and TAL has since integrated this solution with two additional super funds.

Impact

The lodgement portal greatly improved the third-party workflow.

✅ Enhanced visibility of claim statuses.

✅ Significantly reduced claim lodgement lead time from weeks to 3 days.

✅ Minimised missing documents due to clerical error.

✅ Enabled claiming for different benefit types simultaneously.

✅ Allowed claim notification process to begin while awaiting documents to complete lodgement.

Feedback from our users:

“I think this portal is very user friendly. It feels less daunting and is a much quicker and easier process. I look forward to it.”

“I love it because I’d like to know that I’ve lodged a claim. It’s straightforward and easy to use. I’m excited to do this.”

Approach

1. Identifying a problem space where we can make significant impact

Since the claim process is long and complex, we wanted to identify a suitable, low-risk starting point in order to deliver value quickly. During project kickoff, the team aligned with the stakeholders and decided to focus on the following:

🧑🏻💼 Primary users

Third party users for Group insurance policies

We chose to focus on these users due to their substantial share in the overall business and the contractual obligations TAL has with one of the super fund partners to provide an online lodgement portal.

🔍 Scope

Notification and Lodgement process

This is the beginning of the claims process, where there are fewer risks and dependencies. Here, we can easily reduce friction, allowing claims to be lodged more quickly.

Getting a holistic view of our primary users

As the lead designer, I facilitated the User Ecosystem Mapping and User Journey Mapping activities with stakeholder and SMEs.

User Ecosystem Map helps us understand the relationships between multiple parties in the workflow and gave us a holistic view of all the secondary and tertiary users involved.

The insurance claim User Journey lays out the steps the primary users take to accomplish their goals and their interactions with others. We identified pain points, potential gaps, and uncovered technical integration requirements at each stage of the journey.

Overview of the existing third party claim lodgement process

When third parties file a claim, they submit it through the super fund, which then forwards the claim to TAL for assessment.

The bottleneck occurs at the super fund admin team due to lack of manpower that led to a significant backlog. To make matters worse, the admins must complete several tasks before submitting the claim to TAL for assessment:

Perform policy eligibility checks to ensure the policy is valid and premiums are being paid.

Collate and verify all required documents.

Enter member details, claim information, and policy data into another existing app (let’s call this Platform X) and upload the documents to submit to TAL.

2. Prioritising user needs through collaborative problem discovery and validation

With a high-level understanding of our primary users, their journey and pain points, I began diving deeper into the problem space with my team.

Understanding users through just enough research

To ensure our product development efforts addresses user needs, I spearheaded the user research activities. This involved identifying and prioritising the riskiest assumptions we had about our primary users and validating them.

I crafted interview questions to facilitate the user interview, where I then gathered insights on their workflows and pain points. I also invited the PM and engineers to observe these user interview sessions so that they can hear it firsthand and foster empathy for our users.

Finally, I synthesised the research findings and shared them with the entire team to ensure a unified understanding of the top user problems we needed to tackle.

Top user problems

Long lead time

Claims are stuck in the super fund backlog and could take weeks to reach TAL after user submits them to the super fund.

Poor visibility of claim status

Third party users and TAL have no visibility of the claim status when it is sitting in the queue of the super fund waiting to be processed.

Missing documents

Documents often get lost in transit to TAL when the super fund collates them, resulting in further delays.

Repetitive work for multiple benefit types

The paper claim form is tedious and time-consuming to complete, requiring users to repeat the same information when claiming multiple benefit types.

Solicitor vs. Company admin workflows

Solicitors - Solicitors fully represent the claimants, hence they need to provide a Third-Party Authorisation (TPA) Form from the claimants to TAL in order to act on behalf of the claimants.

Company admins - Company admins assist claimants in submitting the claim and providing employment information and documents (i.e. pay slips, rosters). They do not act on behalf of the claimants, hence no TPA form is required.

3. Designing with cross-functional disciplines to develop balanced, well-rounded solutions

Ideating together

With the top problems identified, I facilitated a Design Studio activity to generate ideas collaboratively. Involving the cross-functional team ensures we develop holistic solutions by taking diverse perspectives into consideration.

This approach guarantees that our solutions are user-friendly, valuable to the business, and technically feasible. Designing together also accelerates decision-making and enhances team ownership of the solutions.

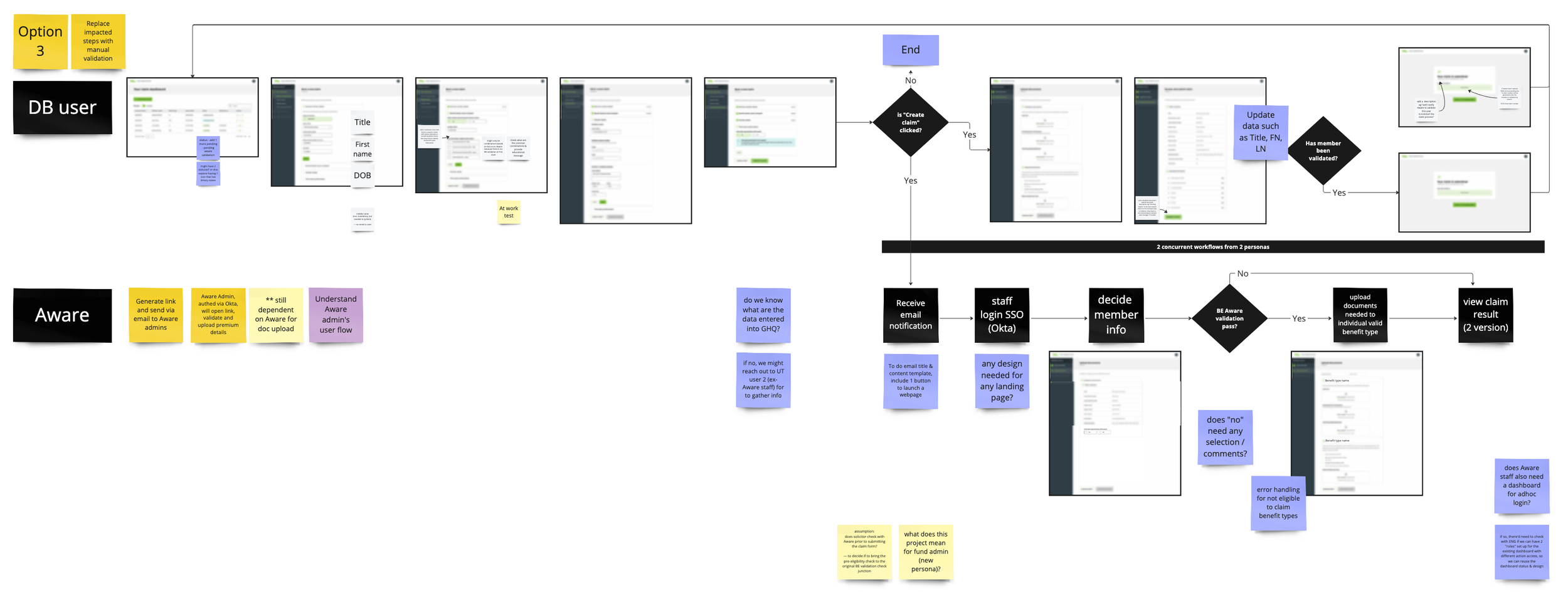

Mapping the new claims lodgement workflow

I mapped out the new lodgement workflow based on the solutions from the Design Studio and shared it with the team to align on the process and feasibility. This helps the team to:

Identify information that we need to get from users at each step and policy data that we can get from the API

Identify integrations with other internal and external systems

Highlight potential risks and issues

Discuss fall back options

Wireframing and concept testing

Round 1

I developed a set of wireframes to quickly test the idea with 2 users and gather initial feedback.

Key findings

👍 Users found the Claims Dashboard useful in keeping track of claim statuses.

👍 Users liked the new document upload feature that guides them to upload mandatory documents.

👍 Users understood that certain benefits that cannot be claimed together and how the app reflected that business rule.

👎 Users were confused by the 2 member number fields required for different policies.

👎 Users mentioned that documents might take time to obtain and they cannot submit the claim until they got them.

“It’s so much better compared to today’s process. It’s a lot easier because we know the claim has been lodged and we can inform our client. This is more streamlined.”

Round 2

Incorporating user feedback from Round 1 and new findings on business processes and technical feasibility, I tweaked the designs and conducted another round of testing with 6 users.

Key findings

👍 Users know where to find the different member numbers with the added tooltip that guides them to find it on the policy statement.

👍 Users liked that they can notify the claim first and upload documents later.

👍 Users are willing to upload files separately, as they sometimes receive the documents individually.

4. Embracing change

Encountered a roadblock due to an API limitation

The initial solution relied on an existing API from the super fund for our app to perform policy eligibility checks and lodge claims directly to TAL via Platform X, an existing portal used by super fund admins for claim submission. The idea was to remove the dependency on super fund admins to manually process claims, which is the current bottleneck.

However, further investigation revealed that the API does not support this functionality and enhancing the API would take months, which poses a significant risk to the project.

Original workflow (API-dependent)

Responding to changes and iterating quickly

Our team came together and generated ideas to workaround this limitation. Within two days, we decided on an alternative and secured stakeholder buy-in. This workaround allows us to launch quickly while working towards an API-powered solution to automate eligibility checks separately.

The workaround

Reintroduced the super fund admins into the workflow to only perform eligibility checks for the first release.

Remained dependent on the super fund admins but significantly reduced their workload by streamlining data entry and document delivery to TAL.

New workflow's independence from super fund APIs allows us to easily adapt the app to accommodate other super funds quickly.

Alternative explorations and workflows

New workflow (Manual eligibility checks)

5. Navigating challenges through active collaboration and complete transparency

Proactive and always-on communication

Throughout the project, we encountered various challenges, including:

Multiple pivots from stakeholders that affected research planning.

Limited access to users for conducting research.

Design stakeholders wanting to cater to all use cases and being uncomfortable with a lean approach.

Issues with the design system, such as logic and interaction limitations, out-of-sync and missing components, etc.

Resistance and skepticism from other internal teams we needed support from.

Technical limitations and dependencies.

The team navigated and overcame these challenges through practices such as constant communication, adaptability to change based on new discoveries, and frequent validation of our assumptions to shorten the feedback loop.

As a team, we addressed and highlighted important issues during our Daily Standups, improve the designs through Design Critique Sessions, clarified and prioritised stories ready for development in our Weekly Iterative Planning Meetings (IPM), and reflected on our progress and challenges in our Weekly Team Retrospectives.

In our Weekly Stakeholder Syncs, we keep stakeholders updated on progress and decisions made. We proactively highlight challenges, blockers, and potential risks to ensure they are well-informed, not caught by surprise, and can help us push the project forward.

Other team activities we run include:

Story Mapping: Collaborating as a team to negotiate and align on MVP features to prioritise and release first.

Product Roadmap Planning: Organising based on research findings, feature value, and technical complexity to give the team and stakeholders a clear picture of what’s coming now, next, and later.

Frequent Pairing Sessions: Facilitating quick product decisions and addressing design implementation issues through regular Design-PM and Design-Engineering pairing sessions.

User permissions management workshop

Because the app sits in the TAL environment, we decided to provide third party users a secure access to the app via the existing TAL Single Sign-On service to reduce development effort.

To align everyone on the approach, I planned and conducted a workshop involving key stakeholders from the SSO and security team to outline the process flow and information required for various key functions such as:

User onboarding and offboarding

Login / Logout

Change password

The workshop provided clarity to all the key stakeholders on the approach and their respective responsibilities to deliver the solution.

Solution

Design considerations

Minimal impact to existing process

The solution needed to avoid adding extra effort for either party and prevent disruption to downstream processes, minimising the need for additional training. Therefore, it has to be integrated into existing internal systems and pathways to lodge claims.

Decoupling claim notification and document upload

Allowing users to notify the claim first and upload supporting documents later enables TAL to begin processing the claim immediately, even while waiting for the documents. This approach minimises delays and streamlines the overall process.

Enabling clear yet flexible document upload

Users receive documents in various combinations from multiple parties (claimants, doctors, employers), and imposing a specific structure could create extra work. Therefore, the app needs to clearly communicate the required documents while allowing users to upload them in any structure they prefer.

Designs

Claim Dashboard

The dashboard provides clear visibility of the claims that users are handling. Users can:

Start a new claim

See the claim status for each individual claim to identify any follow-up actions

Find the Reference/Claim No. for further assistance from TAL

Easily resume providing required details for a claim

View details of submitted claims

Member and Claim Details

We capture only the minimum member and claim details required so that:

Our app can create a case in Platform X (portal used by super funds to submit claims to TAL)

The super fund admin can perform policy eligibility checks

Third-party Authorisation

This step ensures that we capture the Third-party Authority (TPA) Form if necessary so that TAL can reach out to the correct party for future communications to minimise delays.

Notification Success

After submitting the claim details, the super fund and TAL are notified about the claim. Users can upload documents if they have them ready or upload later if they are still waiting. Decoupling the process enables the claims to be notified first so that the super fund and TAL can start the process.

Document Upload

The document upload page allows us to collect the necessary documents for claim assessment:

Claim form (mandatory)

Medical documents (mandatory)

Other supporting documents (optional)

Currently, the users collate all documents into a single PDF due to their existing workflow. While this makes it harder for the assessment team to review the documents (compared to clearly named individual files), we do not want to disrupt their established workflow and potentially create more work for them.

Therefore, for medical and supporting document uploads, we maintain the flexibility to accommodate the various ways users prepare their documents, whether as separate files or one combined file.

Impact

> 50% ⬇️

in notification lead time (from weeks to 3 days)

3

super funds onboarded 6 months after launch

30+

active third party users

> 500

claims submitted monthly on average

✅ Increased efficiency and experience of the claim lodgement workflow

Streamlined the workflow by reducing the steps required to submit a claim and enabling simultaneous claims for different benefit types.

✅ Enhanced claim visibility

Introduced the claim dashboard that enables users to easily track their claim status, leading to a reduction in queries to TAL about the status.

✅ Minimised errors that delay claim assessment

Minimised clerical errors that cause missing documents and further delays in the assessment process.

✅ Enabled concurrent workflows

Allowed claim notification process to begin while awaiting documents to complete the lodgement.

Feedback from the stakeholders

“I don’t think we have ever put something into the market this fast - the process has blown me away and also exposed some gaps in our own mindset.”

“I felt more connected to the solution and the problem.”

Feedback from the project team

“You did a great job in demonstrating the value of design in understanding the problem space and working towards a solution. You also enthusiastically embraced the Design System and demonstrated the value of leveraging existing design patterns in your designs.”

“Your workshop facilitation approach was brilliant—well-planned and targeted to achieve the necessary outcomes. You quickly learned and understood the insurance space, effectively interacted with stakeholders, and were an excellent listener who acted on feedback promptly. Your innovative thinking, teamwork, and patience in a high-paced, challenging environment made working with you a great experience.”